Commercial Loan Program Overview

Comprehensive Commercial Capital Solutions

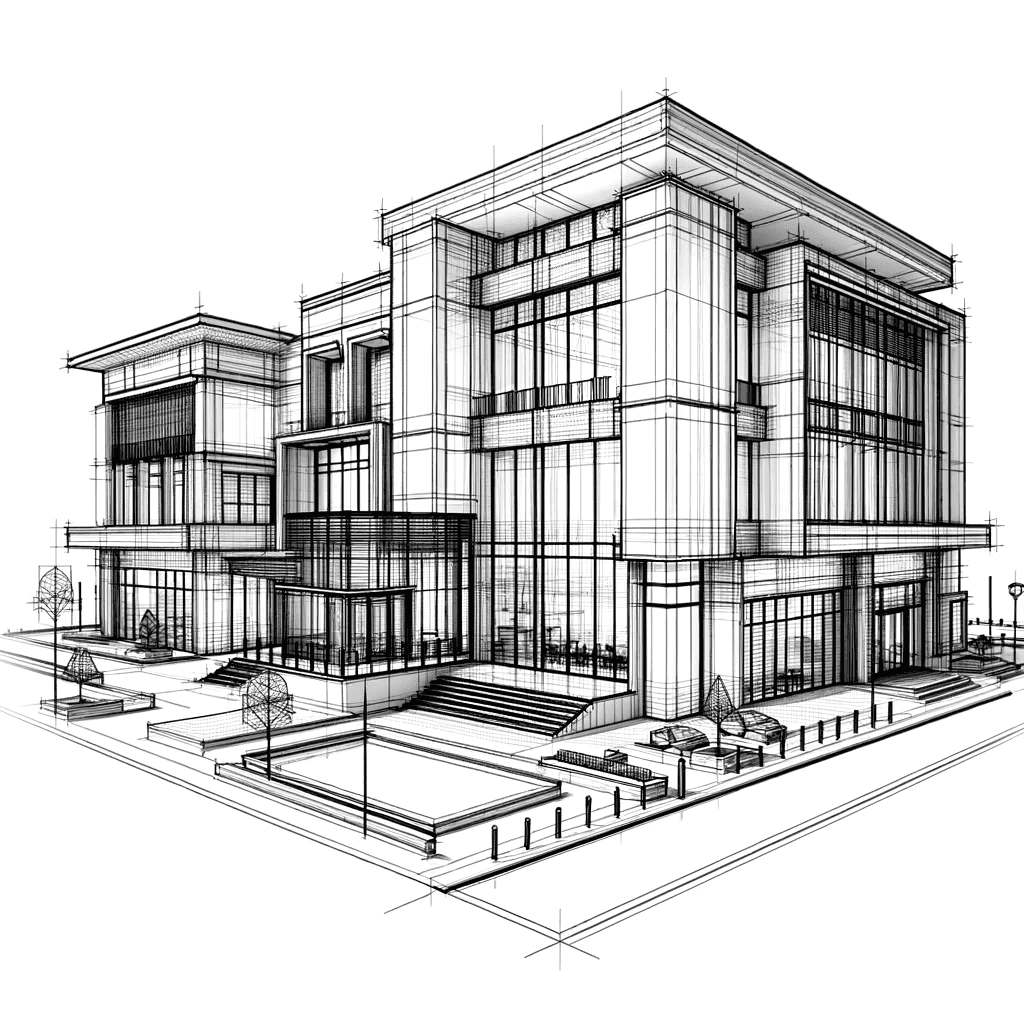

The Comprehensive Commercial Capital Solutions program is designed to meet the diverse financing needs of businesses and real estate investors. Whether you're looking to expand your operations, acquire new properties, or refinance existing loans, our program offers a range of commercial lending options tailored to support your business goals. Our team of experts specializes in structuring financing solutions that are aligned with your project's specific requirements, ensuring flexibility, competitive rates, and a streamlined application process.

Key Features:

- Eligibility: Open to businesses of all sizes, from small enterprises to large corporations, across various industries including real estate, manufacturing, retail, and more.

- Loan Types: A wide array of loan types including commercial mortgages, bridge loans, construction loans, and SBA loans, among others.

- Purpose: Financing available for a variety of purposes such as property acquisition, construction, renovation, working capital, equipment purchase, and debt refinancing.

- Loan Amounts: Offers substantial loan amounts, with minimum and maximum limits tailored to the scale of your project and financing needs.

- Terms: Flexible loan terms, ranging from short-term options for immediate needs to long-term financing for sustained growth and development.

- Interest Rates: Competitive interest rate options, including fixed and variable rates, based on the loan type, creditworthiness, and market conditions.

- Customizable Financing Solutions: Our program emphasizes personalized service, offering customizable loan structures to fit your specific financial situation and project objectives.

Application Process:

1. Initial Consultation: Begin with an initial consultation with our commercial lending specialists to discuss your project, financing needs, and explore suitable options.

2. Documentation: Submit required documentation, which may include business financial statements, tax returns, project plans, property appraisals, and any other relevant information.

3. Loan Application: Complete the detailed loan application process, supported by our team to ensure all necessary documentation and information are accurately provided.

4. Review and Approval: Your application and supporting documents undergo a comprehensive review to assess the viability of the financing request and determine the most favorable terms.

5. Closing: Upon approval, the closing process involves finalizing the loan agreement, securing any necessary collateral, and disbursing funds to proceed with your project.

Support and Expertise: Our dedicated team of commercial lending experts provides ongoing support throughout the application process, offering insights into market trends, regulatory considerations, and strategic financial planning to ensure the success of your project.

Strategic Financial Partner: We position ourselves as more than just lenders; we are strategic financial partners committed to supporting the growth and success of your business. Our goal is to provide the capital and expertise necessary to realize your project's full potential.

Contact Information: To learn more about our Comprehensive Commercial Capital Solutions or to schedule a consultation, please contact our commercial lending department at 718-331-6900 or email us at info@congresscapitalgroup.com

Disclaimer: All loans are subject to approval and must meet our lending criteria. Terms, conditions, and interest rates are subject to change based on the applicant's creditworthiness, the specifics of the project, and market conditions. Please reach out to discuss your specific needs and obtain the most current information.